For a Twelfth Consecutive Quarter, Knoxville-Based Community Bank Posts Record Operating Earnings

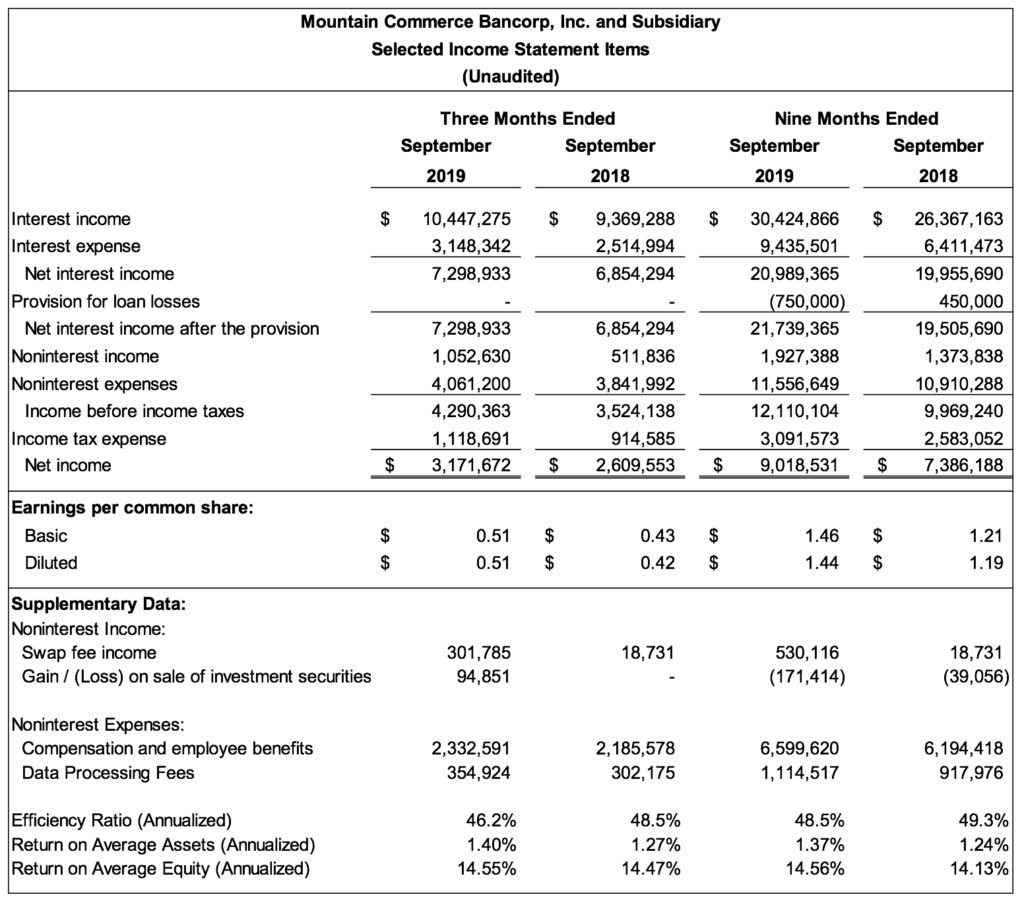

KNOXVILLE, TN — October 21, 2019 — Mountain Commerce Bancorp, Inc. (OTCQX: MCBI), the Knoxville, Tennessee-based bank holding company and parent of Mountain Commerce Bank (MCB), reported consolidated net income of $3.17 million for the third quarter of 2019, up from $2.61 million for the third quarter of 2018, an increase of 22 percent. Earnings per fully diluted share for the quarter ended September 30, 2019 totaled $0.51 versus $0.42 for the third quarter of 2018.

It was the twelfth consecutive quarter in which MCB achieved record operating earnings.

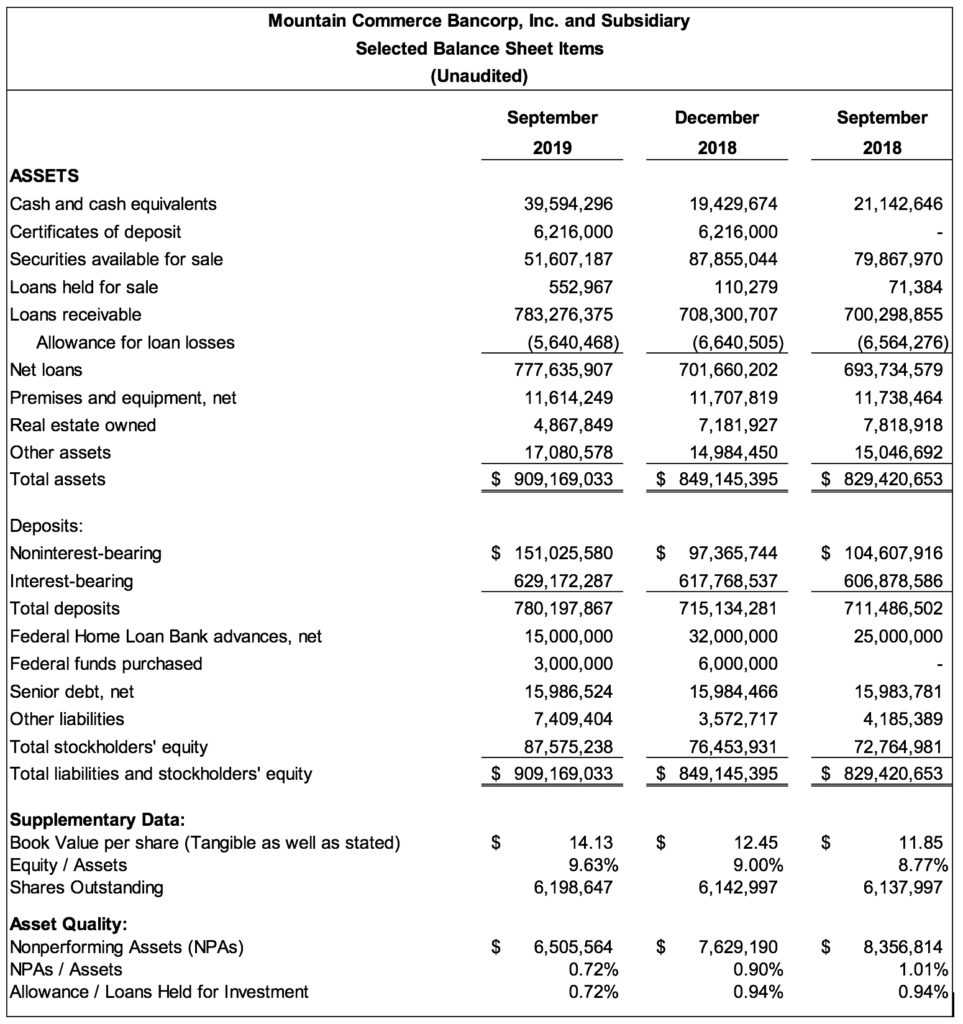

Total assets as of September 30, 2019 were $909.2 million, an increase of $79.7 million or 10 percent from September 30, 2018. Over the same period, gross loans increased 12 percent to $783.3 million, while deposits grew 10 percent to $780.2 million. Shareholders’ equity totaled $87.6 million, or 9.6 percent of assets, at September 30, 2019 versus $72.8 million, or 8.8 percent of assets at September 30, 2018. The tangible book value was $14.13 at the end of the third quarter of 2019 versus $11.85 at the end of the third quarter of 2018, an increase of $2.28, or 19 percent.

For the nine months ended September 30, 2019, the company reported net income of $9.02 million, up from $7.39 million during the same period in 2018, an increase of 22 percent. Earnings per fully diluted share for the nine months ended September 30, 2019 totaled $1.44 versus $1.19 for the same period in 2018.

For the nine months ended September 30, 2019, noninterest income increased 40 percent to $1.93 million from $1.37 million during the same period in 2018. Included in the 2019 income was $530,000 in swap fees earned, which was partially offset by a $171,000 net loss on sale of investment securities.

Earnings also benefitted from a reduction in the provision for loan losses due to the continuation of strong credit metrics. The efficiency ratio in the third quarter of 2019 was 46.2 percent, while annualized ROAE was 14.55 percent and annualized ROAA was 1.40 percent. Nonperforming assets, which includes non-accruing loans and other real estate owned, were $6.51 million—or 0.72 percent of assets—at September 30, 2019 versus $8.36 million—or 1.01 percent of assets—at September 30, 2018.

About Mountain Commerce Bancorp, Inc. and its subsidiary Mountain Commerce Bank:

Mountain Commerce Bancorp, Inc. is a bank holding company and the parent of Mountain Commerce Bank (MCB).

MCB is a state-chartered, FDIC-insured, century-old, financial services institution headquartered in Knoxville, Tennessee and serving East Tennessee. Through Hometown Service and Smart Technology, MCB offers big bank products and services, with the personal attention and exceptional service of a hometown community bank.

At the end of September 30, 2019, MCB had $909.3 million in total assets and $783.5 million in total deposits.

MCB currently employs 83 individuals at five branches and one operations office. For more information, visit us at www.mcb.com or check your account any time at 1-866-MCB-1910. MCB is an equal opportunity employer.